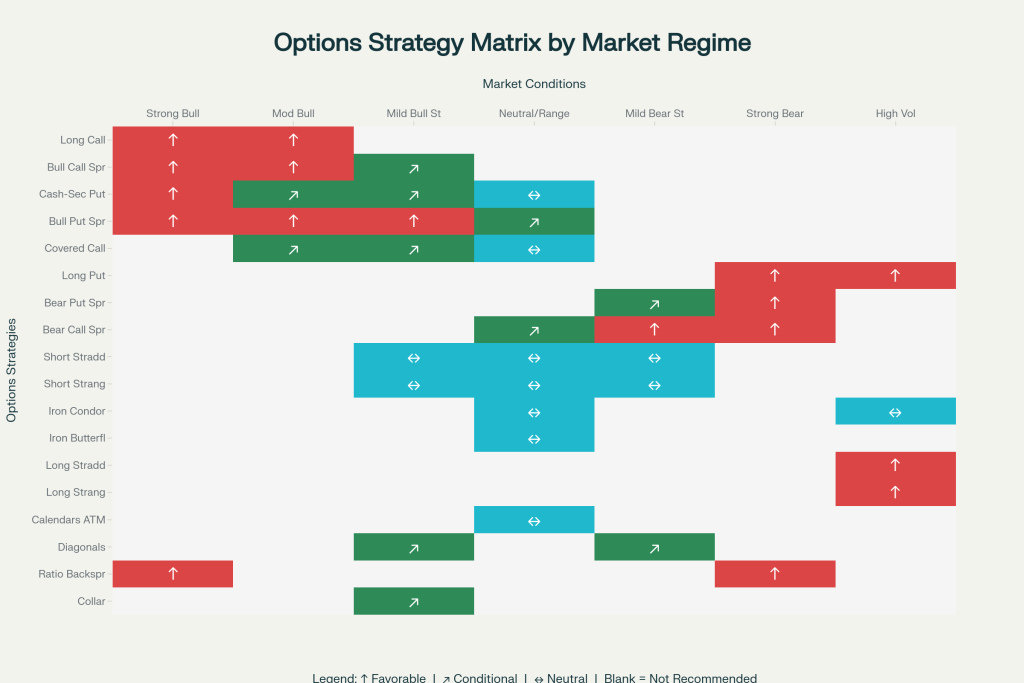

Options Strategy Matrix by Market Regime

Here's the complete options strategy matrix showing which strategies work best across different market conditions

Legend

-

↑ Favorable: Strategy is well-aligned with the market regime; expectancy and risk/reward are attractive

-

↗ Conditional: Works with adjustments or specific filters (IV percentile, strike selection, timing); positive expectancy but requires careful management

-

↔ Neutral: Use primarily for income generation or hedging when directional edges are small; profits rely on theta decay and mean reversion

-

(blank): Not recommended for this regime due to poor expectancy or unfavorable risk/reward dynamics

Implementation Guidelines

IV Filtering Strategy:

- Sell premium when IV percentile > 60 and price is range-bound

- Buy premium when IV percentile < 30 or expecting volatility expansion into events

- Monitor IV rank relative to 252-day historical range for timing entries

NSE-Specific Considerations:

- Prefer defined-risk credit spreads (bull put, bear call) and iron condors for margin efficiency

- Reserve naked short straddles/strangles for advanced traders with strict risk controls

- Use position sizing of 2-5% risk per trade for single-leg strategies, 1-3% for spreads

Risk Management Rules:

- Roll losing positions early at 2x credit received or when short options reach 0.35-0.40 delta

- Widen strike spacing as realized volatility increases beyond expected ranges

- Close profitable positions at 25-50% of maximum profit for spreads, 10-25% for short premium strategies